FinFiles Bridge is an infrastructure that provides fast, direct and uniform regulatory data and information exchange between manufacturers and distributors of investment funds, ETFs and ETPs.

All regulatory and industry-endorsed templates (MiFID II, Solvency II, ESG etc.) are collected, aggregated, validated and disseminated. Other future templates (ie. EFT, taxonomy) are added with the highest speed-to-market.

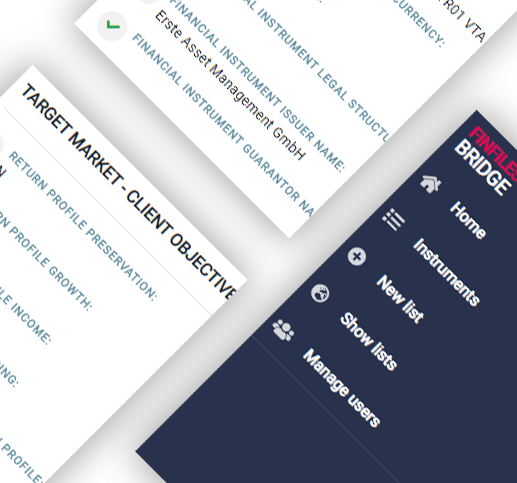

The Bridge portal is a hub for secure, automated and uniform regulatory data sharing, validation, aggregation and dissemination.

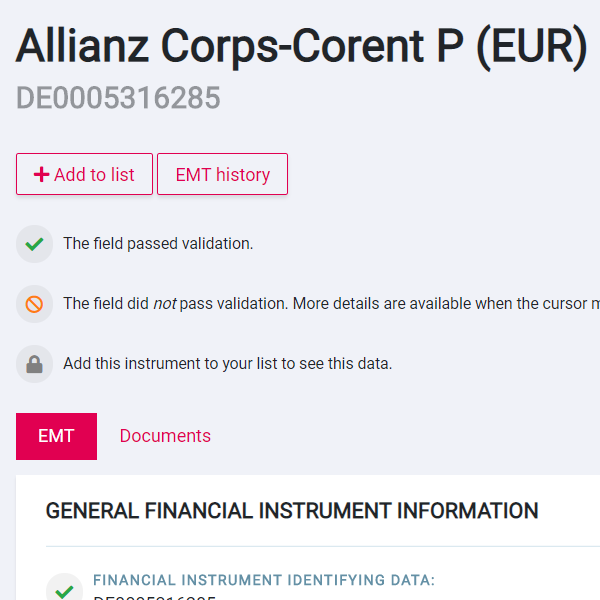

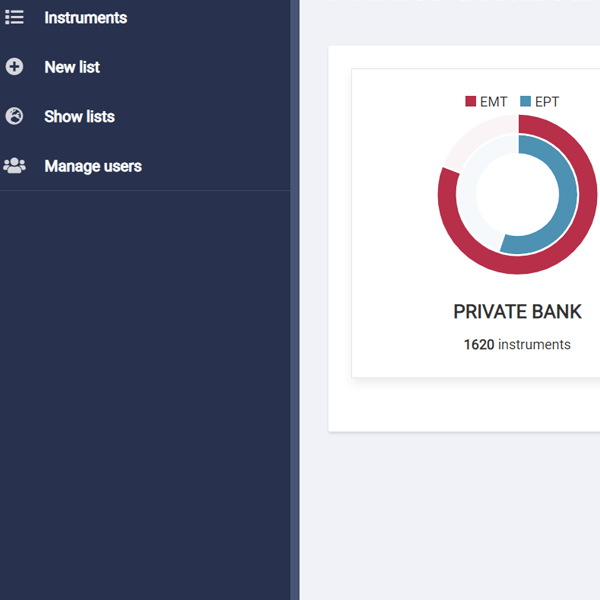

Manage your lists of investment funds, ETFs and ETPs and have an immediate, intuitive instrument overview into the most recent and historical MiFID II data, or filter it as you need.

Most important of all, the data is validated in accordance with the FinDatEx definitions and rules set in the standard templates. It's easy to spot invalid, incorrect or partial data in a template.

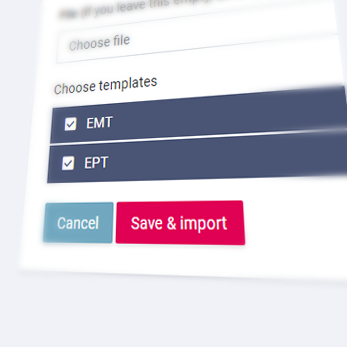

Bridge can quickly import your instrument lists and generate an EMT, EPT & EET coverage check within seconds. See which ISINs are available in the Bridge database and which are not, and review your data in multiple languages.

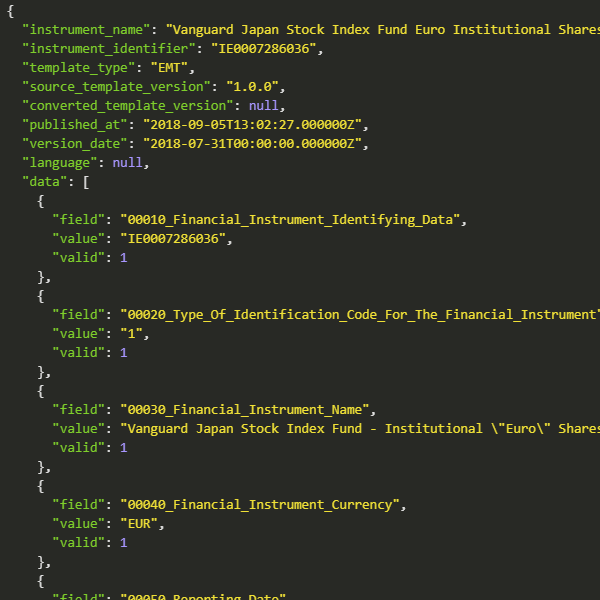

The Bridge API facilitates external aggregation and reporting to include your MiFID II data in your own system, website, intranet or mobile app. Whether it is target market data, UCITS SRRI, distribution strategy and/or the TCO ex-ante.....integrate and automate your data your way!

Get an immediate and aggregated Excel file (EMT, EPT or EET) of your list of instruments. All export files are saved within Bridge to compare previous and historical downloads.

Download an availability Excel report of your list and see which instruments are available and, more importantly, which ones are not - our dedicated data management team will support you and we always strive for being 100% compliant and complete with the fastest time to market.

FinFiles Bridge supports the following data files and versions:

- EMT (v3.0 / v3.1 / 4.0)

- EPT (v1.1 / v2.0 / v2.1)

- EET (v1.0, V1.1)

Any future templates and versions will be added as soon as they are endorsed by FinDatEx.